Alternative Lending: When is it a Right Fit for You, and When is it Not?

You don’t have to walk into your local bank to a get a small-business loan these days. Alternative lending options are just a few computer keystrokes away.

And they’re becoming more popular.

Online lenders, which offer the most common forms of alternative lending, approved 71% of the loan applications they received from small-business borrowers last year, according to a 2015 survey by a group of Federal Reserve banks. That’s the second-highest rate after small banks, which approved 76%, and much higher than the 58% approved by big banks.

But alternative business loans can be complicated and confusing, even risky. They’re not for everyone.

In fact, only 15% of small-business borrowers in the Federal Reserve survey said they were satisfied with their experience with online lenders, the lowest rate among financial institutions in the report. (That compares to 75% for small banks, 56% for credit unions and 51% for large banks.) The top reasons for dissatisfaction given were high interest rates, unfavorable repayment terms and a lack of transparency.

So when is alternative lending good — or not so well — for your business?

Alternative lending is good when you can’t get a bank loan

Alternative lending took off in the wake of the 2008 financial crisis, when banks pulled back dramatically from issuing small-business loans. Online lenders stepped in to fill the void, creating Web-based platforms that could quickly process loan applications, providing relief for small-business owners turned away by banks.

Technology was a key factor in this development, as it allowed new players to swiftly evaluate the creditworthiness of borrowers. Online lenders use different types of data — bank statements, tax returns, online accounting sites and even social media accounts — to analyze potential borrowers’ personal and business finances.

There are four main kinds of alternative or online financing:

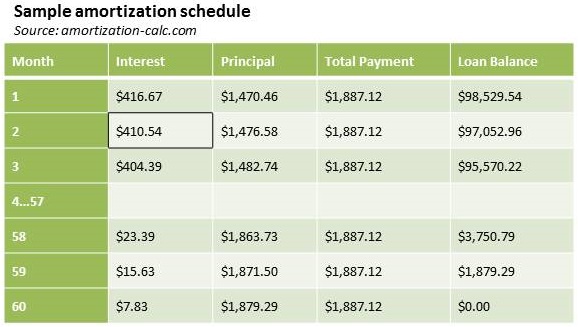

- A term loan is a lump sum you borrow and repay in about four or five years based on set terms, including the annual percentage rate. This is generally the least expensive type of financing.

- A line of credit gives you access to a set amount of cash that you tap when necessary. This is generally used by businesses that need short-term financing to bridge cash-flow gaps.

- Invoice factoring, also known as invoice financing or accounts receivable financing, is an option for small businesses that deal with unpaid invoices. Instead of just waiting to be paid, you can get an advance on those invoices, which you then pay back along with a fee when your customers settle their accounts.

- Merchant cash advances offer a way to get an advance on future credit card or debit card sales. They’re easy to get, but think twice about applying because merchant cash advances are typically very expensive. The APR can range from 70% to 350%.

Banks still offer the best deals, especially federally guaranteed SBA loans. But those are usually tough to get, and you have to deal with stringent requirements and a long wait.

Alternative lending is good when you need quick cash

Alternative lending offers a way to deal with a pressing business need or an emergency. If your plumbing goes out or you suddenly run out of supplies, you can’t really wait weeks, or even days, to fix the problem. Quick access to capital helps you deal with the problem immediately.

With bank loans, especially financing backed by the Small Business Administration, you have to submit a long list of documents, including any business leases and a detailed financial history. In contrast, many online lenders require fewer documents. And for many online lenders, the main focus is whether you have the cash flow to make the payments.

In addition, you can get funds from alternative lenders within days, even a few hours, and the requirements are typically easier to meet.

Alternative lenders also provide longer-term loans to invest in growth, such as opening a new store or hiring more workers. Of course, as noted, in exchange for quicker and easier access, your borrowing costs are likely to be higher.

Alternative lending isn’t good when you get stuck with high APR, steep payments

Getting quick and easy financing has a price. Online lenders generally charge a higher APR, which is the true cost of the loan, including all fees.

A few online lenders offer APRs in the single digits, but you need excellent personal credit and a profitable business to qualify for them.

Most alternative business lenders offer loans with double-digit, even triple-digit, rates.

That’s because most online lenders get their funding from capital markets, so their lending costs are higher than those of banks. And lenders are taking on higher risk to extend credit to borrowers who are likely to be rejected by traditional banks.

Most online lenders also require shorter loan terms, which mean higher regular payments.

Evaluate small-business loans carefully

Alternative lending has multiple upsides — among them, speed, convenience and looser requirements. But it’s essential to compare loans by APR and make sure you can handle the required payments.